Are Universal Life (IUL) Policies a good fit For your Businesses...?

How Financial Growth Architects Help Business Owners Solve Financial Challenges with IUL Policies....

Running a business comes with unique financial challenges, from managing cash flow to planning for retirement and beyond. Darren and the team at Financial Growth Architects understand these issues . We recommend annuities as a strategic solution to address the most pressing concerns business owners face. Here’s how annuities can help...

Problems Business Owners Have That Index Universal Life (IUL) Policies Solve:

Index Universal Life (IUL) policies offer unique benefits that address several financial challenges faced by business owners. Here’s how an IUL policy can be a powerful solution:

1. Lack of Retirement Savings

Problem: Business owners often focus on reinvesting profits into their business, leaving little for retirement savings.

Solution: An IUL policy accumulates cash value that can be accessed tax-free in retirement, providing an additional income source.

2. Cash Flow Volatility

Problem: Business income can be irregular, making consistent savings or investment contributions challenging.

Solution: IUL policies offer flexibility in premium payments, allowing business owners to adjust contributions based on their cash flow.

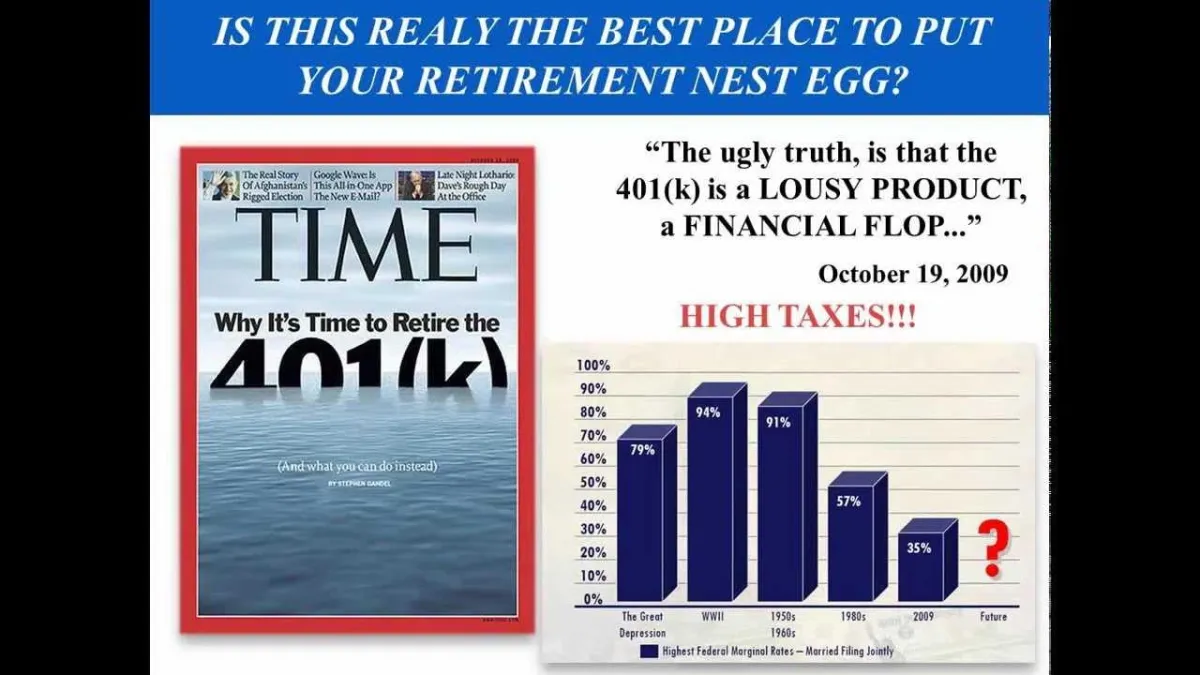

3. Tax Planning Challenges

Problem: Business owners face significant tax liabilities, especially on investment growth.

Solution: IUL policies provide tax-deferred growth on the cash value and tax-free access to funds via policy loans, reducing overall tax burdens.

4. Protection Against Market Downturns

Problem:

Business owners with market-dependent investments risk losing wealth during economic downturns.

Solution:

IUL policies tie cash value growth to a stock market index with downside protection, ensuring that the cash value won’t decrease due to market losses.

Problems Business Owners Have That Index Universal Life (IUL) Policies Solve:

10 Problems an IUL Solves for a Business Owner...

Retirement Savings: Provides tax-free income for retirement, supplementing inconsistent or underfunded plans.

Cash Flow Volatility: Flexible premium payments adapt to irregular business income.

Tax Liabilities: Offers tax-deferred growth and tax-free access to cash value.

Market Risks: Protects against market downturns while offering growth tied to an index.

Wealth Diversification: Reduces reliance on business performance by creating a separate asset.

Estate Planning: Ensures tax-efficient wealth transfer with a death benefit.

Business Continuity: Funds buy-sell agreements and operational needs in case of death.

Employee Retention: Enhances loyalty with executive bonus plans and deferred compensation.

Liquidity Needs: Provides accessible cash value for emergencies or business opportunities.

Debt Repayment: Helps pay off business debts or other financial obligations.

7. Business Continuity in Case of Death

Problem: The sudden death of a business owner can disrupt operations and create financial strain for the company.

Solution: The policy’s death benefit can fund buy-sell agreements, pay off debts, or provide operational capital, ensuring business continuity.

8. Key Employee Retention

Problem: Retaining top talent is challenging without offering competitive benefits.

Solution: Business owners can use IUL policies to fund executive bonus plans or deferred compensation packages, enhancing employee loyalty.

9. Planning for Long-Term Care Costs

Problem: Business owners may face significant healthcare or long-term care expenses later in life.

Solution: Many IUL policies include optional riders that provide coverage for chronic or long-term care needs, reducing future financial stress.

10. Difficulty Accessing Liquidity

Problem:

Business owners often face liquidity challenges, especially in emergencies or economic downturns.

Solution:

The cash value of an IUL policy can be accessed via loans or withdrawals, providing a tax-advantaged source of liquidity when needed.

11. Balancing Growth and Security

Problem: Business owners seek investment options that balance growth potential with financial security.

Solution: IUL policies offer growth tied to market performance with a guaranteed minimum return, ensuring stable and secure financial growth.

12. High Tax Liability on Estate Transfer

Problem: Business owners may face hefty estate taxes when transferring wealth to the next generation.

Solution: The death benefit from an IUL policy can cover estate taxes, allowing heirs to inherit the business or wealth without financial strain.

13. Lack of Financial Flexibility

Problem: Business owners need flexible financial tools to adapt to changing circumstances.

Solution: IUL policies allow policyholders to adjust premiums, borrow against cash value, or use funds for various financial needs, offering unmatched flexibility.

14. Risk of Outliving Savings

Problem: Longer life expectancies increase the risk of outliving traditional retirement savings.

Solution: The accumulated cash value in an IUL policy can provide supplemental retirement income, reducing the risk of running out of money.

15. Business Debt Repayment

Problem: High levels of business debt can create financial stress during challenging times.

Solution: The death benefit or cash value of an IUL policy can be used to pay off business loans or other obligations, reducing the financial burden on the business.