IUL's For tax free retirement...Good?

How Financial Growth Architects Help Business Owners Solve Financial Challenges with Annuities....

Retirement comes with unique financial challenges, from managing cash flow to planning for retirement and beyond. Darren and the team at Financial Growth Architects understand these issues . We recommend annuities as a strategic solution to address the most pressing concerns business owners face. Here’s how annuities can help...

Indexed Universal Life (IUL) insurance policies are a type of permanent life insurance that offers a death benefit along with the potential for cash value growth based on the performance of a market index, such as the S&P 500.

IUL policies are often used as a financial planning tool for retirement because they address several common concerns people face when planning for their retirement. Here's how IUL policies can help solve these problems:

1. Market Volatility and Risk Aversion

Problem: Many people are wary of investing in the stock market due to potential losses, especially as they approach retirement.

Solution: IUL policies provide downside protection by guaranteeing a minimum return (typically 0–1%), ensuring policyholders don't lose money even if the market performs poorly. At the same time, they offer upside potential by crediting interest based on market index performance, up to a cap.

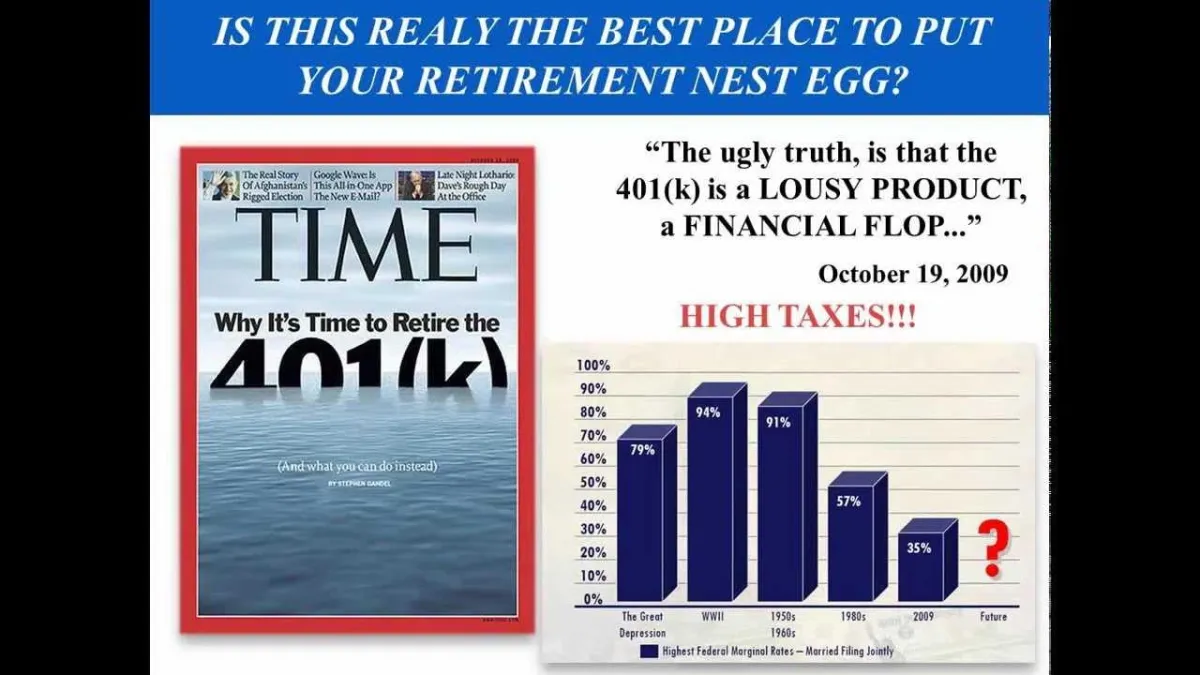

2. Tax Concerns

Problem: Future taxes on retirement income, including 401(k)s and IRAs, can erode savings.

Solution: IUL cash value grows tax-deferred. Additionally, policyholders can access the cash value through loans or withdrawals, often on a tax-free basis, provided the policy is properly structured. This makes IUL policies a tax-efficient retirement income strategy.

3. Longevity Risk

Problem: People are living longer, increasing the risk of outliving their retirement savings.

Solution: IUL policies provide a permanent death benefit, ensuring that loved ones are financially supported regardless of how long the policyholder lives. Additionally, the cash value can serve as a supplemental income source to support long-term financial needs.

4. Low Interest Rates on Savings

Problem: Traditional savings accounts and fixed income investments offer low returns, limiting the growth of retirement funds.

Solution: IUL policies have the potential for higher returns through index-linked interest credits while still offering a level of protection against losses.

Index Universal Life (IUL) Policies Solve Tax-Free Retirement:

10 Problems IUL Solves For Your Retirement...

Taxable Income: IULs offer tax-free growth and withdrawals, minimizing tax burdens on retirement income.

Market Volatility: Provides downside protection with a 0–1% floor, safeguarding against market losses.

Longevity Risk: Ensures you won’t outlive your resources with cash value and a permanent death benefit.

Low Interest Rates: Offers better growth potential than traditional savings vehicles like CDs or bonds.

Inflation: Helps offset inflation with index-linked cash value growth.

Legacy Planning: Guarantees a tax-free death benefit for your loved ones.

Restricted Contributions: No IRS-imposed contribution limits—save as much as you want.

RMDs (Required Minimum Distributions): No forced withdrawals, allowing your money to grow longer.

Liquidity Needs: Provides accessible cash value for emergencies or whatever...

Peace of Mind: Combines financial security with a flexible, personalized retirement solution.

Call Darren at Financial Growth Architects to learn how an IUL can solve these problems and help you retire with confidence!

📞612-802-5570

5. Lack of Flexibility

Problem: Many retirement savings tools, like pensions or traditional annuities, offer little flexibility for unexpected needs.

Solution: IUL policies allow policyholders to access cash value for emergencies, opportunities, or supplemental income without strict penalties, as long as the policy is managed appropriately.

6. Desire for Legacy Planning

Problem: Retirees often want to leave a financial legacy for their loved ones or charities but may lack a clear plan to do so.

Solution: The permanent death benefit ensures a financial legacy, which is often income-tax-free for beneficiaries, helping retirees meet their estate planning goals.

7. Inflation Risk

Problem: Inflation reduces the purchasing power of fixed income streams during retirement.

Solution: The potential for higher returns linked to market performance helps IUL cash value growth keep pace with or outpace inflation, providing additional income flexibility.

Considerations and Limitations

While IUL policies offer several benefits, they are not a one-size-fits-all solution. Potential downsides include:

High fees, particularly in the early years of the policy. A learning curve to fully understand the policy structure. Caps and participation rates that can limit growth potential.

Who Should Consider IUL Policies for Retirement?

Individuals looking for tax-advantaged retirement savings options. Those seeking a balance between growth potential and risk protection. People interested in combining life insurance with retirement planning.

IUL policies can be a versatile tool, but it's essential to consult a financial advisor or insurance professional to determine whether they align with your retirement goals and financial situation.

Are Indexed Universal Life (IUL) Policies a Good Retirement Vehicle?

Absolutely!

Indexed Universal Life (IUL) policies are a unique and powerful retirement planning tool that combines life insurance with the potential for tax-advantaged cash value growth. They offer a variety of benefits that can help you meet your financial goals while protecting your future.

Here’s why IULs stand out as a smart choice for retirement planning:

Key Benefits of IULs for Retirement - Tax-Free Retirement Income

The cash value in an IUL policy grows tax-deferred, and you can access it tax-free through policy loans or withdrawals.

This can provide a reliable source of supplemental income during retirement without worrying about tax brackets.

Growth Potential with Protection - - IULs offer the opportunity to earn interest linked to market indices like the S&P 500. Even better, they include a floor (often 0–1%), so you’re protected from market losses. This makes them a great option for conservative savers who want growth without taking on significant risk.

Flexibility for Life's Changes - - Life is unpredictable. An IUL policy gives you the flexibility to adjust premium payments, access cash value for emergencies, or use the funds to capitalize on opportunities—all while maintaining a death benefit for your loved ones.

Inflation Protection - -The growth potential in an IUL can help offset inflation, ensuring your retirement dollars maintain their purchasing power.

Leave a Legacy - - An IUL policy guarantees a tax-free death benefit, ensuring your loved ones are financially secure and your legacy is preserved.

Why IULs Are Ideal for Retirement Planning

Unlike traditional retirement accounts, such as 401(k)s or IRAs, IULs offer:

No Contribution Limits: Save as much as you want without restrictions.

NO Required Minimum Distributions (RMDs): Keep your money growing for as long as you wish.

Access to Cash Value Anytime: Use your funds when you need them most, without penalties (if structured properly which we are able to do).

Take Control of Your Retirement Today

If you're looking for a retirement strategy that combines growth, safety, flexibility, and tax advantages, an IUL policy may be the solution you've been searching for.

Let’s design a retirement plan tailored to your needs and goals. Contact Darren at Financial Growth Architects to explore how an IUL can empower your financial future.

📞

Call Darren Today: 612-802-5570

Don’t wait—secure your retirement and protect your legacy with the power of IUL!