Get personalized financial advice to help you achieve your goals in the shortest time.

We provide personalized advice to help our clients reach their financial goals in the short and long term. We know that what matters most to our clients. We offer Powerful Products with a personal touch.

About Me

Transparency, integrity, and trust form the foundation of our relationships with clients. I pride myself on providing objective advice, staying current with market trends, and adapting our strategies to the evolving financial landscape.

Retirement is in REACH...are you ready?

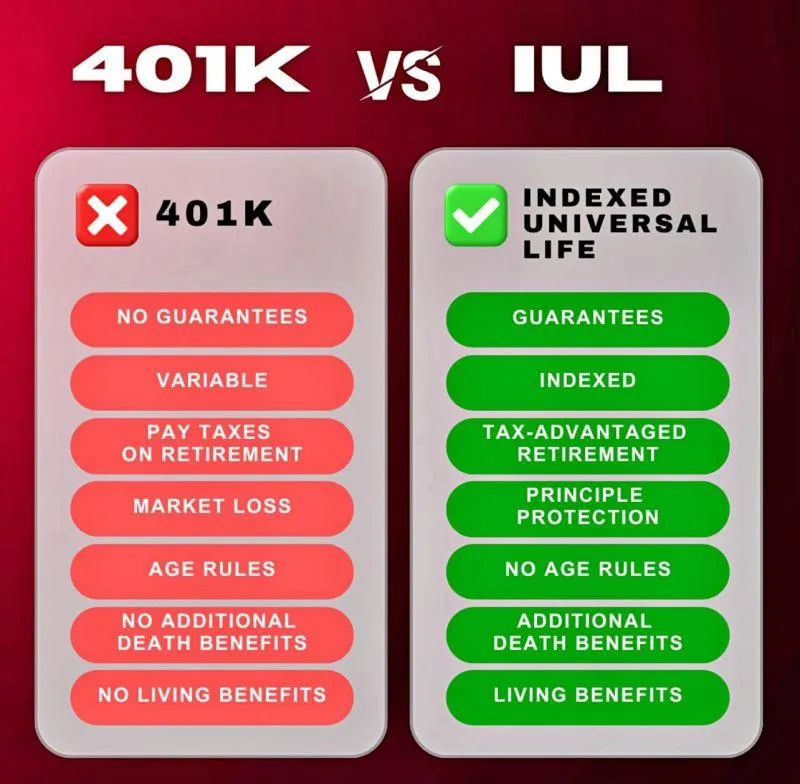

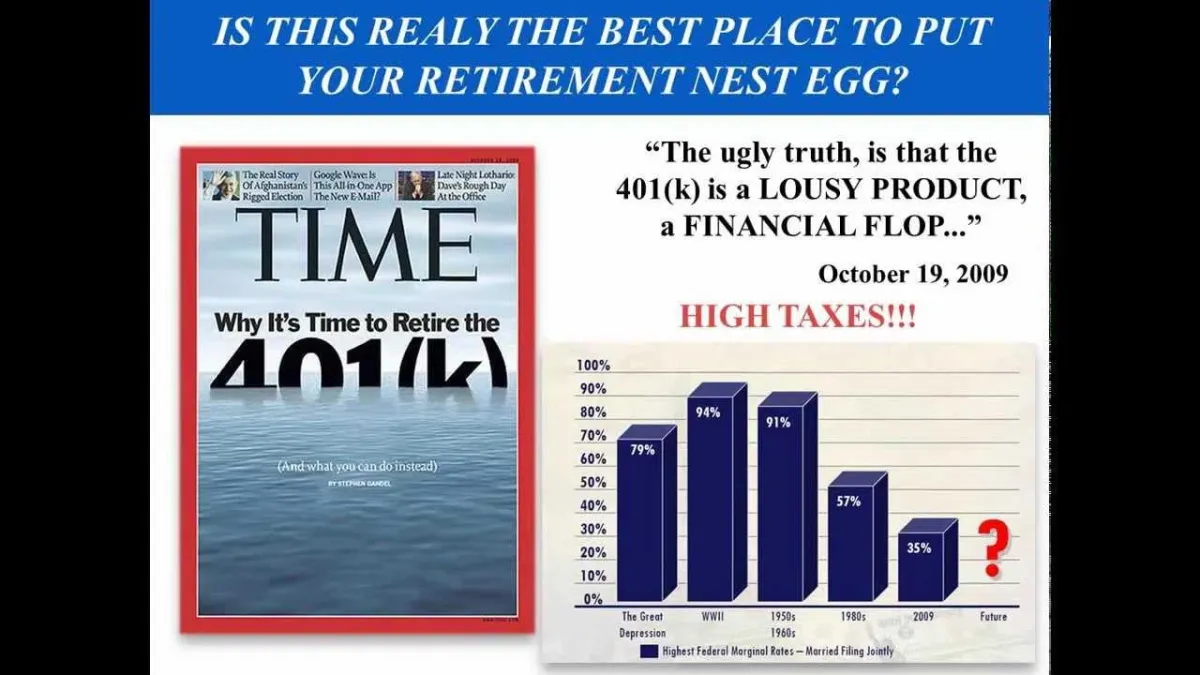

Are you looking for a way to reduce your taxes and increase your wealth?

If so, then an IUL may be the right investment for you. An IUL can provide major tax advantages that can help you both during your lifetime and after you pass away.

Plus, with the right strategy, an IUL can also help you grow your wealth faster than other investments. If you’re interested in learning more about how an IUL can benefit you, Contact Me!

IUL/Index Universal Life

Funds in these Indexed Universal Life policies typically are structured to participate in market gains at the performance of an index, such as the S&P 500 while being insulated from market losses. When the market goes up you get those gains when it goes down you don’t lose.

You can access your money via a loan Tax-Free while alive. Money accumulates tax-free and income via loans are Tax-Free. Living Benefits plus structured monthly Tax-Free payments...Contact me to see if you qualify

High-Performing Annuities

Own an Annuity for what it Will Do with Fixed Rates, Not Tied to Market Ups and Downs Determining if an annuity is the right product…finding the correct annuity type for you, is the most important part of achieving your financial goals.

Traditional Life Insurance

*Final Expense Insurance is a whole-life policy that pays medical bills and funeral expenses when you die. It's also known as burial or funeral insurance.

*Whole Life Insurance offers many benefits, including:

Guaranteed death benefit - A payout is guaranteed to your loved ones when you pass away. The death benefit is not usually subject to federal income taxes.

*Term Life Insurance has several benefits, including:

Cost-effective - - Term life is generally less expensive than a permanent whole life policy.

Life Settlement

WHY WOULD SOMEONE SELL THEIR POLICY?

Senior-owned term and universal life policies that will terminate without paying a death benefit is a crazy 75%...

People terminate their policies for many good reasons as well, including:

• The policy is no longer needed

• Premiums are too costly

• Cash surrender value is depleted

With retirement growing increasingly expensive for Americans, including the rising costs of healthcare and long-term care, seniors increasingly need additional income to achieve the retirement they’ve worked for.

Often, the life insurance policy someone has contributed towards for years is one of their most valuable assets – and they may not know it.

The Financial Growth Architects Team

Our team is the driving force behind our commitment to your financial success. Comprised of seasoned professionals with diverse expertise, our team members share a common passion for empowering individuals and businesses to navigate the complexities of finance.